What is a Stock Average Calculator for Multiple Buys?

A stock average calculator for multiple buys helps investors determine their weighted average purchase price when buying shares at different prices. Whether you’re dollar-cost averaging (DCA) or averaging down, this tool ensures accurate tracking of your investment cost basis.

Why Use a Stock Average Calculator?

✅ Avoid Manual Errors – Automatically calculates your average price.

✅ Track Multiple Buys – Supports SIP, swing trading, and long-term investing.

✅ Helps in Averaging Down – Lowers your break-even point.

✅ Useful for Indian Investors – Works for NSE, BSE, Upstox, Zerodha, etc.

How to Calculate Average Stock Price for Multiple Buys

Method 1: Manual Formula

Average Price = (Total Investment Amount) / (Total Shares Bought)

Example:

| Buy Order | Shares | Price per Share | Total Cost |

|---|---|---|---|

| 1st Buy | 10 | ₹100 | ₹1,000 |

| 2nd Buy | 15 | ₹80 | ₹1,200 |

| 3rd Buy | 20 | ₹90 | ₹1,800 |

| Total | 45 | – | ₹4,000 |

Average Price = ₹4,000 / 45 = ₹88.89 per share

Method 2: Excel/Google Sheets

=SUM(C2:C10)/SUM(B2:B10)

(Where Column B = Shares, Column C = Total Cost)

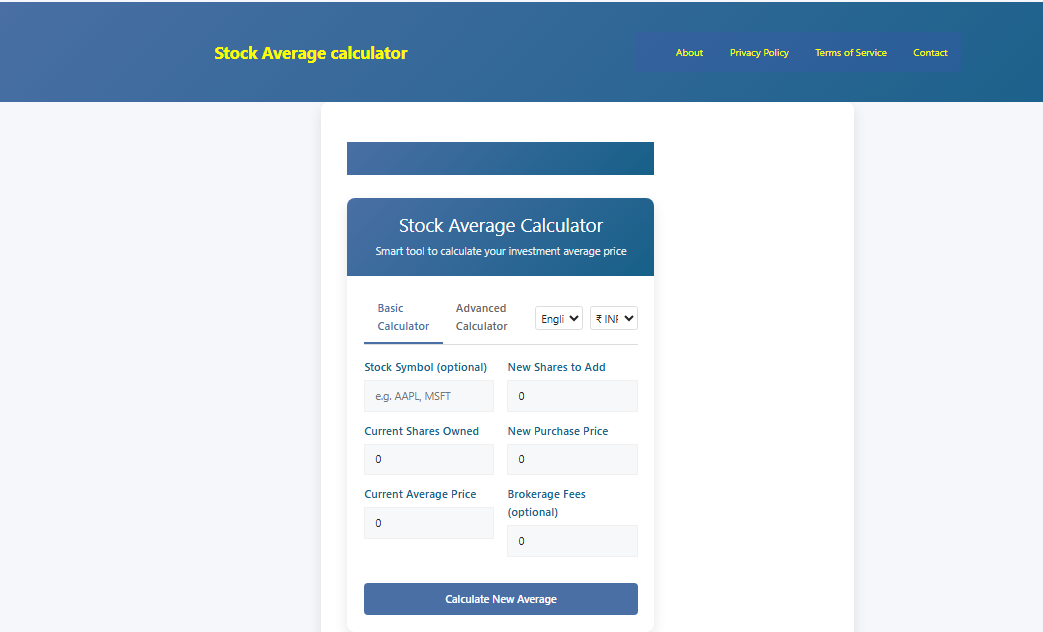

Method 3: Use a Free Online Stock Average Calculator

For quick results, try:

🔗 StockAverageCalculator.space (Best for Indian investors)

Best Stock Average Calculators (Free Tools)

- StockAverageCalculator.space (Simple & Fast)

- Upstox Portfolio Tracker (For Upstox users)

- Zerodha Console (Cost basis tracking)

- Excel Stock Average Calculator (Customizable)

FAQs on Stock Average Calculation

Q1. How does dollar-cost averaging (DCA) work?

- You invest fixed amounts at regular intervals, reducing market timing risk.

Q2. What is the difference between FIFO & Weighted Average?

- FIFO = First In, First Out (Oldest shares sold first).

- Weighted Average = Blended cost of all shares.

Q3. Can I use a stock average calculator for intraday trading?

- Yes, but it’s more useful for long-term investors & swing traders.

Q4. Is there a stock average calculator app?

- Yes! Try StockAverageCalculator.space (Mobile-friendly).

Pro Tips for Accurate Stock Averaging

📌 Update After Every Trade – Keep your records accurate.

📌 Use Stop-Loss – Avoid heavy losses when averaging down.

📌 Compare Brokers – Some (like Upstox/Zerodha) have built-in average calculators.

Final Thoughts

A stock average calculator for multiple buys is essential for Indian stock market investors. Whether you use manual formulas, Excel, or a free online tool, tracking your average price helps in better decision-making.

🚀 Try Our Free Tool: Stock Average Calculator